Diamond demand to normalise in 2017

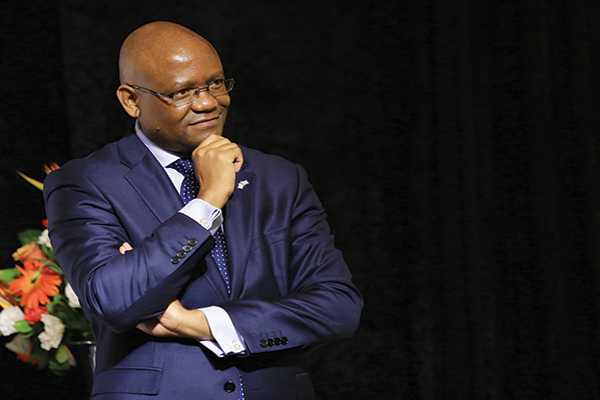

Debswana Mining Company’s Managing Director, Balisi Bonyongo says although the diamond market seems to have stabilised, this does not call for any celebration yet. It emerged from the company’s stakeholder engagement this week Tuesday that the world’s biggest diamond producer by value has realised a business improvement of 40 percent, a three-points increase from last year’s figure.

The improvement was largely driven by higher revenue from strong rough diamond demand, favourable exchange rates and improved cost and operational efficiencies. The first three cycles of the year 2017 started on a promising note with the cycles reaching US$729m, US$553m and US$580m respectively. Carats produced remained in line with 2015 production at 20.5 million carats, because of the company’s strategy to produce to demand by maximising production at its core assets and scaling down at its lower value.

However, Bonyongo cautioned that nonetheless, volatility remains. “A volatile situation is complex and anything can happen. We have to be aware of the global dynamic macro-economics when making decisions. 2017 will be a stable year and will probably remain so going ahead. 2015 stocks were all sold last year and destocking started taking place by sizeable numbers and the rough diamond demand is expected to normalise in 2017,” said Bonyongo.

The global growth will depend on macroeconomic factors including; the policies of the new Trump administration in the US; the strengthening of the US dollar impacting consumer demand, economic performance in China as well as the effects of the Indian demonetisation. US is however expected to remain the main driver of the global growth through 2017.

With the anticipation of continued sales and price volatility, Bonyongo emphasised that Debswana shall maintain its operational flexibility, drive costs and operational efficiencies and improve planning and forecasting.

The company’s response to these external shocks is guided by its commitment to safety matters; employee engagement and morale and driving cost and operational efficiencies hence doing more with less; preserving jobs in readiness for an upturn; investing in projects to sustain the future of Debswana; investing in communities within which Debswana operate to leave a legacy of prosperity and sustainability; investing in health and wellness and; investing in citizen economic empowerment.

Addressing the shareholders’ Annual General Meeting this week in London, Sir John Parker, Chairman of Anglo American plc indicated that looking to 2017… on the demand side, the fortunes of the mining industry will inevitably continue to be influenced by developments in China, where the authorities have recently reduced the country’s growth target for 2017 to 6.5 percent as the country seeks to balance its economy through a mixture of stimulus and managed slowdown.

Turning to Anglo American’s performance last year, which Debswana is a member through De Beers; Parker emphasised the importance of safety. Although the Anglo group had a most encouraging 24 percent reduction in recordable injury rates compared with 2015, the number of people who lost their lives at its operations increased from six to 11.

This contrasted sharply with the declining trend of the past few years. “It was all the more surprising, given the increased focus on safety across the Group, including our emphasis on critical controls in high safety-risk areas. As a Board, we regard each loss of life with great sadness, and it is particularly distressing that several of these fatal incidents were preventable, given that they resulted from front-line operational practice being out of alignment with our safety policies,” he said.

While there was a clear imperative to reduce net debt during 2016, the underlying asset strategy holds true. Going forward, Parker says the Group’s commitment remains to a portfolio focused on the highest quality assets where they can deliver attractive margins and returns in the context of the right corporate and capital structure.